I don’t know how you first heard about the FDIC, but today I’m here to unlock its full power—How saving account insured by the FDIC—the benefits, the claim process.

Across the United States, countless banks proudly offer FDIC insurance. This isn’t a privilege for a select few—it’s a right for every account holder. Yes, rules and regulations may vary slightly from bank to bank, but the foundation remains solid and consistent everywhere.

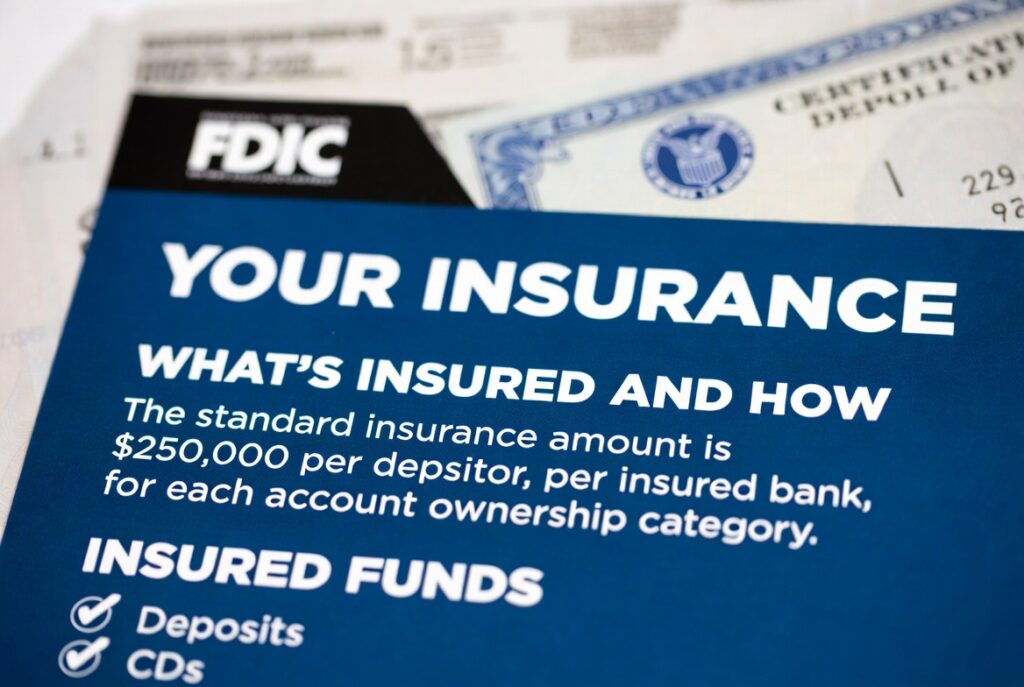

Let’s break it down: FDIC stands for the Federal Deposit Insurance Corporation, a U.S. government agency born in 1933 during one of the toughest times in history. Its mission? To protect depositors and restore confidence in the banking system. And here’s the best part—you, me, and anyone can access this benefit simply by opening an account at an FDIC-insured bank.

What does it cover?

- Savings accounts

- Checking accounts

- Money market deposit accounts

- Certificates of deposit (CDs)

All insured up to $250,000 per depositor, per bank, per ownership category.

In an era of economic uncertainty, safeguarding your hard-earned money is not just smart—it’s essential. For millions of Americans, FDIC-insured savings accounts are more than just accounts; they are a safety net, a promise, and a guarantee that your money is secure.

So here’s the point of this page: to break down everything you need to know about How saving account insured by the FDIC—its benefits to customers, the government’s perspective, how to access it, which banks participate, and how to claim if the unexpected happens.

Because when it comes to your future, confidence is everything—and FDIC insurance delivers exactly that.

Savings Account Insured by the FDIC

The working process of FDIC is beautifully simple—yet incredibly powerful. Think of it like insurance you already know:

- Vehicle insurance protects your car.

- Home insurance protects your house.

- Health insurance protects you in critical conditions.

But here’s the difference: FDIC insurance protects your money itself.

The Coverage Limit

The FDIC sets a standard coverage limit of $250,000 per depositor, per FDIC-insured bank, per ownership category.

Ownership categories include:

- Single accounts

- Joint accounts

- Retirement accounts (like IRAs)

- Trust accounts, and more

Example: If you have a single savings account and a joint account with your spouse at the same bank, each is insured separately up to $250,000. That means together, you could be covered for $500,000 total.

What FDIC Does Not Cover

It’s important to know FDIC insurance only applies to deposits. It does not cover:

- Stocks

- Bonds

- Mutual funds

- Annuities

- Crypto assets—even if sold by the bank

FDIC is about protecting your cash deposits, not your investments.

Backed by the U.S. Government

FDIC insurance is backed by the full faith and credit of the United States government. It’s funded primarily through premiums paid by insured banks—not taxpayer dollars.

And here’s the inspiring part: as of 2025, there have been no major changes to these limits or structures. The $250,000 cap, established in 2010, still stands strong—your safety net remains intact.

Saving account insured by the FDIC is not just a policy—it’s a promise. A promise that your savings are secure, your future is protected, and your confidence in the banking system is well placed. In a world of uncertainty, FDIC stands as a rock-solid guardian of your money.

Benefits to Customers

- Quick and Safety of Funds: Even if a bank fails, your deposits remain protected. Thanks to FDIC insurance, access to your insured funds is typically restored within just a few business days—keeping your life moving forward with minimal disruption. It’s not just coverage, it’s a guarantee of security and stability for your hard‑earned money.

- Peace of Mind: No more sleepless nights during financial crises; your savings are secure.

- No Extra Cost: FDIC insurance is automatic and free. Banks cannot charge you for this protection—it’s built in.

- Wide Coverage: Most U.S. banks and savings institutions proudly carry FDIC insurance, giving millions of Americans confidence in their accounts.

- Increased Confidence: Knowing your savings are protected encourages you to save and invest more, which in turn strengthens the banking system and opens doors to better financial products.

- Flexibility for Larger Balances: By spreading funds across multiple banks or ownership categories, you can insure well beyond the $250,000 limit, ensuring even greater protection.

By insuring deposits, the government builds a shield around the financial system. This protection reduces systemic risks, empowers banks to attract more deposits and expand lending, and prevents the economy from collapsing under cascading failures. It is a proactive safeguard—strengthening the nation’s banking infrastructure and delivering stability that benefits every individual, family, and community across society.

How to Access FDIC Insurance

Accessing saving account insured by the FDIC is not complicated—it’s built into the very foundation of America’s banking system. You don’t need to chase offers or fill out special applications. The moment you deposit money into an FDIC-insured bank, your protection begins.

Steps to Unlock FDIC Protection

- Open an Account at an FDIC-Insured Bank: Choose a savings or checking account at any institution carrying the FDIC seal. Coverage activates automatically.

- Look for the FDIC Logo: Whether online, at a branch, or on account documents, the logo is your assurance of safety.

- Verify Coverage: Use the FDIC’s “BankFind” tool or the Electronic Deposit Insurance Estimator (EDIE) at edie.fdic.gov to calculate your exact coverage based on account types and balances.

- Stay Within Limits: Standard coverage is $250,000 per depositor, per bank, per ownership category.

Maximizing Your Protection

If your savings exceed $250,000, you can still expand your safety net:

- Spread Funds Across Multiple Banks: Each FDIC-insured bank provides its own $250,000 coverage.

- Use Different Ownership Categories: Individual, joint, retirement, and trust accounts each qualify separately.

- Explore CDARS: The Certificate of Deposit Account Registry Service allows larger balances to be insured across multiple institutions seamlessly.

Monitor and Maintain

Regularly review your account statements—including accrued interest—to ensure deposits remain within insured limits. No extra fees, no hidden sign-ups. Just the simple act of depositing money at an FDIC-insured bank guarantees your protection.

Which Banks Provide FDIC Insurance?

When it comes to protecting your money, the FDIC stands tall as a guardian of trust. Nearly all U.S. banks and savings associations are FDIC-insured—covering over 4,500 institutions nationwide. That means whether you bank with a national giant, a regional leader, or an online innovator, chances are your deposits are already shielded by this powerful safety net.

Participating Banks

FDIC membership spans across the banking landscape:

- National Giants: JPMorgan Chase, Bank of America, Wells Fargo, Citibank.

- Regional Leaders: PNC, U.S. Bank, Truist.

- Online Innovators: Ally Bank, Capital One, Discover Bank.

From bustling city branches to digital-first platforms, FDIC insurance ensures your savings are secure.

How to Confirm Coverage

Want to be absolutely sure your bank is FDIC-insured? It’s simple:

- Look for the FDIC Logo: At physical branches, on websites, or in account documents.

- Use the BankFind Suite Tool: Visit banks.data.fdic.gov/bankfind-suite/bankfind to search by name, location, or history.

- Call Directly: Dial 1-877-ASK-FDIC (1-877-275-3342) for verification.

What About Credit Unions?

Credit unions aren’t covered by FDIC, but they have their own guardian: the National Credit Union Administration (NCUA). Through the National Credit Union Share Insurance Fund (NCUSIF), deposits enjoy the same $250,000 protection.

How to Claim FDIC Insurance

Bank failures are rare, but when they do happen, the FDIC is ready to step in as your guardian of financial security. The claims process is designed to be seamless, fast, and depositor-friendly. In fact, you usually don’t even need to lift a finger—the FDIC handles it automatically.

Step-by-Step Process

- Notification: Saving account insured by the FDIC will announce the bank’s failure and outline next steps through media, the bank’s website, or direct communication.

- Payout Options: Within just a few business days—often the very next day—the FDIC will:

- Transfer your insured deposits to a new account at another FDIC-insured bank, or

- Issue a check for the insured amount, including principal and accrued interest up to the failure date.

What If You Have More Than $250,000?

- Excess Amounts: If your deposits exceed the $250,000 coverage limit per category, the uninsured portion may still be partially recovered. The FDIC, acting as receiver, sells the failed bank’s assets and distributes payments over time. While not guaranteed, it often helps reduce losses.

Special Cases

For complex accounts—like trusts or brokered deposits—you may need to provide documentation. In such cases, you can:

- Use the FDIC Claims Portal

- Call 1-866-799-0959 to schedule an appointment with a claims agent

Access Resources

Stay informed and empowered:

- Visit fdic.gov for updates on failed banks

- Use the Failed Bank Customer Service Center for personalized help

Leave a Reply