On this page, you will get different types of business bank accounts in U.S. In the U.S., common types include checking, savings, money market accounts (MMAs), certificates of deposit (CDs), merchant accounts, and multi-currency accounts. These differ primarily in liquidity, interest earnings, transaction limits, and suitability for specific business needs (e.g., daily operations vs. long-term savings).

Different Types of Business Bank Accounts

You’ve worked hard to build your business, and the way you manage your money can either fuel your growth or hold you back. Business bank accounts aren’t just a formality—they’re the backbone of financial discipline. By separating your personal and business finances, you simplify tax preparation, strengthen your credit profile, and keep cash flow running smoothly. More importantly, you project professional credibility to clients, partners, and investors.

With the right account, you also unlock specialized tools like payment processing, merchant services, and even international transfers—all designed to help you operate with confidence and scale faster. You can also integrate this account with your payment gateway. When customers make payments through your website, the funds will be deposited directly into your business account.

Common Types of Business Bank Accounts in the U.S.

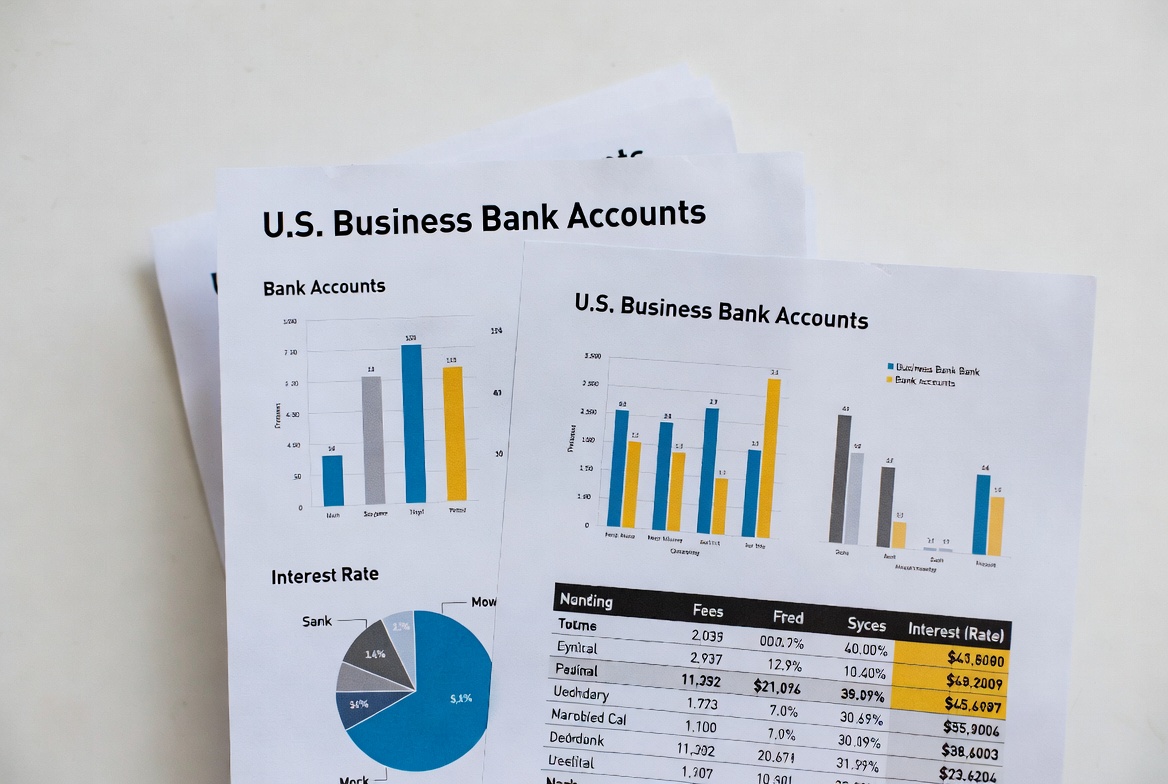

Below is a comparison table highlighting the key aspects of business bank accounts, followed by detailed explanations tailored to your needs. You’ll see how each option supports your growth, liquidity, and credibility. Insights are drawn from reliable financial resources as of late 2025.

Business Checking Accounts

A business checking account is the financial heartbeat of your company, designed to handle everyday transactions like payroll, bill payments, deposits, and fund transfers. typically, its greatest strength lies in accessibility—unlimited deposits and withdrawals, debit card usage, online banking, and seamless integration with accounting software or invoicing platforms. Unlike savings or money market accounts, which focus on growth, checking accounts prioritize operational efficiency, making them indispensable for managing cash flow and keeping personal and business finances separate.

Traditional brick‑and‑mortar banks often provide in‑person support but may charge monthly fees, while online options emphasize digital tools, fee‑free structures, and even perks like business credit card cash‑back rewards or sign‑up bonuses. The trade‑off is that checking accounts typically earn little to no interest (though some high‑yield versions offer up to 2.50% APY). Restrictions can include minimum balance requirements, transaction limits at physical branches, or caps on cash deposits in online accounts. Despite these drawbacks, the account simplifies tax preparation, builds business credit, and supports high‑volume operations from startups to large corporations—sometimes even offering extended FDIC insurance coverage up to $3 million.

Business Savings Accounts

A business savings account is your safety net, designed to store surplus funds while earning interest. Think of it as the place where you build reserves for taxes, emergencies, seasonal fluctuations, or future expansion. Unlike checking accounts, which focus on daily operations, savings accounts emphasize disciplined accumulation with limited access—usually capped at six fee‑free withdrawals per month under federal rules.

These accounts are ideal for excess profits you don’t need immediately. They often come with features like sub‑accounts for goal tracking, easy transfers linked to your checking account, and FDIC protection for peace of mind. Online banks may offer higher yields (up to 3.60% APY), making them attractive for freelancers or small businesses looking to maximize idle cash.

The trade‑offs are clear: savings accounts are safer than investing and simpler than money market accounts, but they earn modest interest compared to CDs or MMAs. They typically don’t provide debit cards or checks, and interest is taxable. Restrictions on withdrawals and cash deposits mean they’re not suited for daily use, but they shine when it comes to building emergency funds, covering unexpected expenses, and promoting financial discipline.

Business Money Market Accounts (MMAs)

A business money market account is the sweet spot between checking and savings, giving you both accessibility and stronger interest earnings. It’s perfect if your business has stable cash flow and wants to keep short‑term reserves for taxes, upgrades, or expansion while still earning more than a standard savings account.

MMAs typically offer tiered interest rates—up to 2.75% APY in competitive options—alongside limited check‑writing, debit card access, and ATM withdrawals. This makes them more flexible than certificates of deposit (CDs), which lock in funds, but they still come with restrictions: usually capped at six penalty‑free withdrawals per month and higher minimum balance requirements (sometimes $25,000 to unlock the best rates).

The real advantage is that MMAs blend the best of both worlds: liquidity for occasional access and growth potential for idle funds. They’re FDIC‑insured, secure, and convenient for businesses with consistent income streams. However, they’re not ideal for high‑frequency transactions or volatile cash flows, since minimums can tie up capital and fees may apply if balances dip below thresholds.

In short, MMAs reward disciplined businesses with better returns while keeping funds accessible when needed—a smart choice if you want your money to work harder without sacrificing flexibility.

Business Certificates of Deposit (CDs)

A business certificate of deposit is the disciplined saver’s tool—perfect for locking away surplus funds and earning guaranteed higher interest. CDs commit your money for fixed terms ranging from three months to five years, making them ideal for long‑term goals like expansions or major equipment purchases.

Unlike savings or money market accounts, CDs don’t allow flexible access. Funds remain inaccessible until maturity, and early withdrawals often trigger penalties such as forfeiting months of interest. Yet the trade‑off is predictable growth: guaranteed fixed rates that are typically higher than other deposit accounts, FDIC insurance for security, and automatic rollovers to keep your money working without interruption.

Businesses often use a laddering strategy, staggering multiple CDs with different maturities to balance liquidity and returns. This approach ensures periodic access to cash while still benefiting from higher yields. CDs are especially useful for stable businesses with consistent income, offering a low‑risk way to grow idle funds without exposure to market volatility.

The limitations are clear—fixed‑term lock‑ins, penalties for early withdrawal, and rates that remain static regardless of market changes. But for risk‑averse companies seeking predictable, long‑term savings, CDs provide a reliable foundation for financial stability and growth.

Merchant Accounts

A merchant account is the engine behind your ability to accept electronic payments— business credit cards, debit cards, and online transactions. Acting as an intermediary, it securely processes customer payments and deposits the funds into your business checking account, minus applicable fees. Unlike general banking accounts, merchant accounts are specialized for payment acceptance, with settlement times typically ranging from one to two days.

For e‑commerce stores, retail shops, and digital businesses, merchant accounts are essential. They integrate with payment gateways, support multi‑currency transactions, and often provide tools for analytics, fraud prevention, and chargeback management. This not only improves cash flow but also enhances customer convenience, expanding your reach to global markets.

The trade‑offs come in the form of transaction fees (per sale or annual), setup and compliance requirements, and the risk of chargebacks. Contracts may include auto‑renewal clauses, so careful review is critical. While merchant accounts boost credibility and secure processing, they are not designed for non‑payment operations, and verification delays can slow onboarding.

Foreign & Multi‑Currency Accounts

If your business operates across borders, a foreign or multi‑currency account becomes a powerful tool. These accounts allow you to hold, receive, and send money in different currencies, reducing costly conversion fees and protecting against exchange rate fluctuations. Unlike standard domestic checking accounts, they’re built for importers, exporters, and global service providers who need versatility.

Multi‑currency accounts consolidate several currencies under one roof, while foreign accounts typically focus on a single currency. Both simplify cross‑border payments, enable faster international transfers, and often come with FX tools, online banking, debit cards, and even interest‑earning options. This makes them more efficient for multi‑country operations and helps businesses capitalize on favorable exchange rates.

The trade‑offs include higher maintenance fees, exposure to exchange rate volatility, and more complex management requirements. Compliance can be stricter, with extra documentation needed to open or maintain the account. They’re not cost‑effective for businesses that operate only domestically, and some versions limit access to specific currencies.

Why These Accounts Matter

Opening the right mix of accounts isn’t just about convenience—it’s about legal compliance, credibility, and growth.

- They keep personal and business finances separate, which is critical for LLCs and corporations.

- They simplify tax preparation and record‑keeping for IRS audits.

- They project professionalism to clients and vendors.

- They unlock access to loans, credit lines, and merchant services that fuel expansion.

Trade-Offs You Face

- Liquidity vs. Growth: Checking accounts maximize accessibility, while CDs maximize returns but tie up funds.

- Fees vs. Benefits: Traditional banks may charge fees unless balances are high; online banks often reduce costs but limit branch access.

- Risk vs. Stability: Savings and CDs are stable but less flexible, while MMAs balance moderate risk with better yields.

Choosing Wisely

Apart from the types mentioned above, business bank accounts can also be categorized in these ways.

Your decision depends on business size, transaction volume, cash needs, and international scope.

- Online banks (like Bluevine or Live Oak) often offer higher APYs and fewer fees.

- Traditional banks (like Chase or Bank of America) provide branch access and in‑person support but may come with higher costs.

- Always confirm FDIC insurance and compare APYs and fee structures before committing.

Don’t forget Business Credit Card Accounts: while not deposit accounts, they extend credit for expenses, build your business credit profile, and offer rewards like cashback. The downside is high interest if balances aren’t paid off, and the risk of debt accumulation.

Leave a Reply