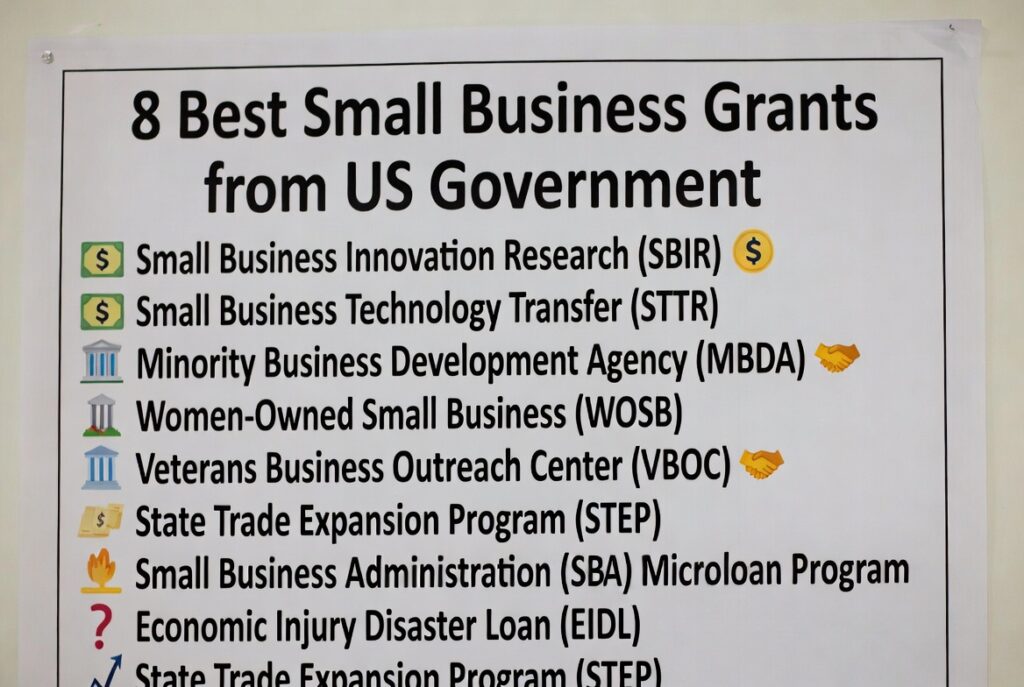

On this page, we’ll explore the top 8 small business grants offered by the U.S. government. Every business requires funding—whether for working capital, innovation, expansion, or other needs. Here, you’ll discover which grant programs best fit your business, complete with an introduction to each scheme, eligibility requirements, and the maximum funding available. Continue reading to uncover all 8 grants in detail.

US Government Grants for Small Business

In today’s fast-paced entrepreneurial environment, funding can make or break a small business. While many owners turn to loans, grants stand out as a powerful alternative—providing capital without the burden of repayment. The U.S. government, through agencies like the SBA, USDA, and Department of Commerce, has rolled out programs that fuel innovation, economic growth, and community development. These initiatives are especially critical in 2025, as businesses navigate recovery and seize opportunities in rural areas and emerging technologies.

Small business grants from the U.S. government differ significantly in both eligibility requirements and funding levels. For instance, SBIR and STTR programs award between $50,000–$250,000 in Phase I and can exceed $1 million in Phase II, while USDA Rural Business Development Grants generally have a maximum of $500,000. Each grant program sets its own criteria based on factors such as industry, geographic location, and business ownership.

U.S. Government Free Business Funding

In 2025, federal grants are opening doors for small businesses across America. Starting and scaling a small business often requires significant funding. Unlike loans, grants provide capital without repayment obligations, making them highly attractive. This article highlights eight top programs designed to empower entrepreneurs, with details on eligibility, funding potential, and application strategies. From innovation-driven projects to rural and minority-owned enterprises, these grants reflect the diversity and resilience of the U.S. business landscape. Explore the top U.S. government grants—complete with eligibility details and funding potential—to help your venture grow.

1. Small Business Innovation Research (SBIR) Program

The SBIR Program is a major U.S. government initiative that helps small businesses turn new ideas into real products. It’s run by the Small Business Administration (SBA) along with agencies like the Department of Defense, NIH, and NSF. The goal is to support early-stage research and help businesses move from concept to commercialization.

What It Does

- Provides money for research and development (R&D) projects with strong business potential.

- Focuses on science, technology, and innovation.

- Offers funding in three phases: testing the idea, building a prototype, and commercialization.

Who Can Apply

- Must be a for-profit small business with fewer than 500 employees.

- At least 51% owned by U.S. citizens or permanent residents.

- Business must be based in the United States.

- Project must align with federal research goals and show potential for commercialization.

- Nonprofits, universities, and large corporations cannot apply.

Funding Levels

| Phase | Purpose | Funding | Duration |

|---|---|---|---|

| Phase I | Test the idea (proof-of-concept) | Up to $275,000 | 6–12 months |

| Phase II | Build prototype | Up to $1.8 million | 2 years |

| Phase III | Commercialization | No direct funding, but access to federal contracts | Varies |

How to Apply

- Submit applications through SBIR.gov (agency-specific solicitations).

- Multiple opportunities are available each year.

- Success rates are around 15–20%, so proposals must be strong and detailed.

Key Points

- Highly competitive program with strict evaluation.

- Typical awards: $50,000–$250,000 in Phase I, and over $1 million in Phase II.

- Winning proposals must show clear outcomes and a path to market adoption.

2. Small Business Technology Transfer (STTR) Program

The Small Business Technology Transfer (STTR) Program is a sister initiative to SBIR, designed to foster public–private partnerships that accelerate innovation. Coordinated by the Small Business Administration (SBA), STTR requires small businesses to collaborate with nonprofit research institutions—such as universities or federal labs—making it especially valuable for ventures that need academic expertise to advance cutting-edge technologies.

Program Overview

- Encourages collaborative R&D between small businesses and research institutions.

- Focuses on commercializing federally funded research.

- Ideal for startups and small firms seeking to leverage academic or institutional knowledge.

Eligibility Requirements

To participate, applicants must meet the following criteria:

- Be a for-profit small business with fewer than 500 employees.

- At least 30% of the work must be performed by the small business, and 30% by the research partner.

- At least 51% owned and controlled by U.S. citizens or permanent residents.

- Operate primarily within the United States.

- Align with the mission of the sponsoring agency (e.g., Department of Energy for energy projects, NIH for health-related research).

- Sole proprietorships without an R&D focus are not eligible.

- Funding Structure : STTR provides phased funding similar to SBIR:

Application Process

- Proposals are submitted via Grants.gov or agency-specific portals during open solicitations.

- Applications are strengthened by robust partnerships with research institutions.

- Awards are distributed across multiple federal agencies, each with its own focus areas and priorities.

Key Notes

- STTR is similar to SBIR, but collaboration with a nonprofit research institution is mandatory.

- Funding ranges from $100,000 to over $1 million, depending on project phase and scope.

- Success depends on demonstrating both technical merit and a clear path to commercialization.

3. State Trade Expansion Program (STEP)

The State Trade Expansion Program (STEP), administered by the Small Business Administration (SBA), is designed to help small businesses break into international markets. By funding activities such as trade shows, overseas marketing, and market research, STEP provides targeted export assistance. Since funds are distributed through state governments, the program is regionally tailored to meet local business needs.

Program Overview

- Supports small businesses seeking to start or expand exporting.

- Provides reimbursement for costs tied to international trade activities.

- Tailored by state agencies to reflect regional priorities and industries.

Eligibility Requirements

To qualify, businesses must:

- Be a U.S.-based small business under SBA size standards.

- Be new to exporting or actively expanding into foreign markets.

- Meet state-specific criteria, often including revenue thresholds (commonly under $35 million annually).

- Offer goods or services with clear export potential, with priority given to underserved exporters.

- Exclusions: Firms primarily exporting services or those with significant foreign ownership.

Funding Amounts

- Awards typically range from $15,000–$25,000 per business annually, depending on state allocations.

- The program’s total funding for FY 2025 is approximately $30 million.

- Eligible expenses include international marketing, trade missions, translation services, and travel costs.

Application Process

- Applications are submitted through your state’s trade office once SBA allocates funds to states.

- Deadlines vary by state, often on a quarterly basis.

- Contact information and application details are available on the SBA’s official STEP program page.

Key Notes

- STEP funding is competitive and limited, so early application is recommended.

- Smaller awards (typically $5,000–$10,000) are common for activities like trade shows and compliance support.

- Strong proposals highlight both export readiness and the potential for international growth.

4. Rural Business Development Grants (RBDG)

The Rural Business Development Grants (RBDG) program, administered by the U.S. Department of Agriculture (USDA), is designed to strengthen economic growth in rural communities. By funding technical assistance, training, and infrastructure projects, RBDG empowers nonprofits, public bodies, and tribal organizations to support small businesses in underserved rural areas.

Program Overview

- Focused on economic development in rural regions with populations under 50,000.

- Provides resources for training, technical assistance, and infrastructure improvements.

- Prioritizes projects that benefit distressed communities or introduce innovative initiatives.

Eligibility Requirements

Applicants must demonstrate clear community benefit and meet the following criteria:

- Projects must serve rural areas (population <50,000).

- Eligible applicants include public bodies, nonprofits, and tribal organizations that provide services to small rural businesses.

- Must show a viable project plan and a demonstrated need for economic development.

- Priority is given to proposals that target economically distressed regions or offer innovative solutions.

Funding Amounts

- Grants typically range from $10,000 to $500,000, with smaller requests often favored.

- No strict maximum limit, though awards are capped by available program funding.

- FY 2025 program budget: approximately $30–40 million nationwide.

- Larger awards may require matching funds of up to 25%.

Application Process

- Applications are submitted through state USDA Rural Development offices.

- National deadlines usually fall around March and September each year.

- Proposals must include detailed project plans, community impact assessments, and financial documentation.

Key Notes

- RBDG funding is indirect—grants go to nonprofits or public entities that then support rural businesses.

- Strong applications highlight community need, sustainability, and measurable outcomes.

- The program is highly competitive, with emphasis on projects that deliver long-term economic benefits.

5. Economic Development Administration (EDA) Grants

The Economic Development Administration (EDA), part of the U.S. Department of Commerce, provides grants that drive regional growth by funding infrastructure, planning, and innovation projects. These grants are particularly impactful in economically distressed areas, where they help create jobs, strengthen resilience, and stimulate local economies. Popular programs include Public Works and Economic Adjustment Assistance, both of which support small businesses and communities facing economic challenges.

Program Overview

- Supports projects that stimulate local economies and promote job creation.

- Funds initiatives in infrastructure, planning, and innovation.

- Tailored to regions with high unemployment or low income, ensuring resources reach communities most in need.

Eligibility Requirements

Applicants must demonstrate clear economic benefit and meet the following criteria:

- Projects must be located in economically distressed regions.

- Eligible applicants include for-profit businesses, nonprofits, and local governments.

- Proposals must show measurable economic impact, such as jobs created or retained.

- Compliance with environmental regulations and civil rights laws is required.

- Small businesses may apply directly or through partnerships with regional organizations.

Funding Amounts

- Awards range from $100,000 to $10 million, depending on the program.

- Construction-related projects typically average $1–3 million.

- Requires a local match of 20–50%, depending on project type.

- FY 2025 program budget exceeds $1 billion nationwide.

Application Process

- Applications are accepted on a rolling basis via Grants.gov.

- Regional EDA offices provide tailored guidance and support for applicants.

- Strong proposals emphasize measurable outcomes, particularly job creation and economic resilience.

Key Notes

- EDA grants are often awarded to regional organizations that then support small businesses.

- Funding is highly competitive, with priority given to projects that demonstrate long-term economic impact.

- Successful applicants typically combine local matching funds with federal support to maximize project scope.

6. Minority Business Development Agency (MBDA) Grants

The Minority Business Development Agency (MBDA), part of the U.S. Department of Commerce, provides targeted grants to strengthen minority-owned businesses. Delivered primarily through MBDA Business Centers, these grants help entrepreneurs gain access to capital, contracts, and new markets. In 2025, the program places special emphasis on technical assistance and equity-driven initiatives, ensuring that socially and economically disadvantaged business owners receive the support they need to grow and compete.

Program Overview

- Supports minority-owned businesses with capacity building and market expansion.

- Provides technical assistance, counseling, and access to MBDA services.

- Focuses on advancing equity goals and helping businesses overcome systemic barriers.

Eligibility Requirements

To qualify, applicants must:

- Be at least 51% owned and controlled by socially or economically disadvantaged individuals (e.g., Black, Hispanic, Native American).

- Operate as a U.S.-based for-profit business with demonstrated growth potential.

- Commit to utilizing MBDA services such as business counseling and technical support.

- Excludes highly profitable firms that do not demonstrate a clear development need.

Funding Amounts

- $10,000–$100,000 for technical assistance grants.

- Larger awards up to $350,000 for MBDA Business Center operations (businesses benefit indirectly through these centers).

- FY 2025 allocation includes approximately $11 million in new technical assistance competitions.

Application Process

- Businesses apply through local MBDA Business Centers (find locations via MBDA.gov).

- Alternatively, respond to Funding Opportunity Announcements (FOAs) posted on Grants.gov.

- Deadlines are ongoing, with opportunities announced throughout the year.

Key Notes

- MBDA grants are often indirect, with funding awarded to centers that then provide services to businesses.

- Direct grants to firms are smaller, but the technical assistance and networking opportunities can be transformative.

- Strong applicants demonstrate both growth potential and a clear need for development support.

7. USDA Value-Added Producer Grants (VAPG)

The Value-Added Producer Grants (VAPG) program, administered by the U.S. Department of Agriculture (USDA), is designed to help agricultural producers transform raw commodities into higher-value products. By funding activities such as processing, marketing, and branding, VAPG enables farmers and cooperatives to diversify their operations, strengthen profitability, and build more resilient rural businesses.

Program Overview

- Supports projects that add value to agricultural products beyond basic production.

- Encourages innovation in branding, product development, and market expansion.

- Acts as a lifeline for small and mid-sized farms, helping them compete in modern agribusiness.

Eligibility Requirements

Applicants must meet the following criteria:

- Be an independent agricultural producer, producer group, or cooperative.

- At least 51% owned and controlled by U.S. citizens or permanent residents.

- Operate within the United States.

- Project must clearly enhance value (e.g., new product lines, branding, or processing).

- Priority is given to beginning farmers, socially disadvantaged producers, and small/mid-sized operations.

- Basic production activities alone are not eligible.

Funding Amounts

- Planning Grants: Up to $75,000 for projects lasting 12 months.

- Working Capital Grants: Up to $250,000 for projects lasting 24 months.

- Requires a 50% matching contribution from applicants.

- FY 2025 program funding is approximately $40 million nationwide.

Application Process

- Applications must be submitted via Grants.gov.

- Deadlines typically fall in the spring each year.

- Strong applications include feasibility studies, market analysis, and detailed business plans to demonstrate viability.

Key Notes

- VAPG is highly competitive, with emphasis on projects that show clear market potential.

- Matching funds are essential—applicants must demonstrate financial commitment.

- Successful proposals

8. National Institutes of Health (NIH) Small Business Grants

The National Institutes of Health (NIH) offers a suite of small business grants—most notably the SBIR (R43) and STTR (R44) mechanisms—to advance biomedical research and development. These programs are designed to help small businesses bring healthcare innovations to market, from cutting-edge diagnostics to novel therapies. By bridging early-stage research with commercialization, NIH grants play a pivotal role in turning scientific breakthroughs into real-world medical solutions.

Program Overview

- Funds biomedical R&D projects aligned with NIH priorities (e.g., cancer, infectious diseases, neurological disorders).

- Supports small businesses developing innovative healthcare technologies with strong commercialization potential.

- Encourages collaboration with academic researchers to strengthen proposals.

Eligibility Requirements

Applicants must meet the following criteria:

- Be an SBA-defined small business focused on NIH research priorities.

- At least 51% owned and controlled by U.S. citizens or permanent residents.

- The principal investigator (PI) must be primarily employed by the small business.

- Projects must demonstrate high commercialization potential.

- Early-phase clinical trials are not eligible.

Funding Amounts

- Phase I (Feasibility Studies): Up to $325,000 for projects lasting 6–12 months.

- Phase II (Prototype Development): Up to $2.2 million for projects lasting 2 years.

- Phase III (Commercialization): No direct NIH funding, but opportunities for federal contracts and partnerships.

Application Process

- Applications are submitted via NIH’s eRA Commons system.

- NIH offers multiple receipt dates each year, providing flexibility for applicants.

- Strong proposals often include collaborations with academic or clinical researchers, enhancing scientific rigor and competitiveness.

Key Notes

- NIH grants are highly competitive, with emphasis on projects that address significant public health needs.

- Success depends on demonstrating both scientific merit and a clear pathway to commercialization.

- Awards can be transformative, providing millions in funding to help small businesses bring life-saving innovations to market.

8. HUBZone Program

- Administered by: Small Business Administration (SBA)

- Purpose: Provides preferential access to federal contracts for businesses in Historically Underutilized Business Zones.

- Eligibility: Must be a small business with its principal office in a HUBZone and at least 35% of employees living in HUBZone areas.

- Funding: Not a direct cash grant, but offers contracting advantages worth millions annually.

Beyond the Big Seven: Hidden U.S. Small Business Grants

While programs like SBIR, STTR, STEP, RBDG, EDA, MBDA, VAPG, and NIH are widely recognized, the U.S. government also offers a range of lesser-known grants and initiatives that can be just as valuable for entrepreneurs in 2025. These opportunities often fly under the radar but provide critical support for businesses in niche sectors, underserved communities, and specialized industries.

1. Community Development Block Grant (CDBG) Program

- Administered by: U.S. Department of Housing and Urban Development (HUD)

- Purpose: Funds local governments to drive community and economic development, including small business support.

- Eligibility: Small businesses benefit indirectly through city or county programs (e.g., façade improvements, micro-loans).

- Funding: Varies by locality; typically $10,000–$500,000, depending on project scope.

2. EPA Small Business Innovation Research (SBIR) Grants

- Administered by: Environmental Protection Agency (EPA)

- Purpose: Supports small businesses developing environmental technologies such as clean water solutions, pollution control, and sustainable materials.

- Eligibility: U.S.-based small businesses with ≤500 employees.

- Funding: Phase I awards up to $100,000; Phase II up to $400,000.

3. Department of Energy (DOE) Small Business Vouchers Pilot

- Administered by: DOE’s Office of Energy Efficiency and Renewable Energy

- Purpose: Provides vouchers for small businesses to access DOE national labs for technical assistance and collaboration.

- Eligibility: Energy-focused small businesses working on clean energy technologies.

- Funding: Vouchers worth up to $300,000.

4. U.S. Department of Transportation (DOT) Disadvantaged Business Enterprise (DBE) Program

- Administered by: Department of Transportation (DOT)

- Purpose: Helps minority- and women-owned businesses compete for federally funded transportation projects.

- Eligibility: At least 51% owned and controlled by socially or economically disadvantaged individuals.

- Funding:

Risks & Challenges

- Not for general startup costs: Most federal grants are designed for specific industries or purposes, not everyday business expenses.

- Intense competition: Programs such as SBIR/STTR have acceptance rates below 20%, making strong proposals essential.

- Indirect funding: Many grants are awarded to nonprofits or institutions that then provide support to small businesses, rather than direct cash awards.

- Compliance burden: Recipients must meet strict reporting requirements and demonstrate measurable outcomes, which can be time-consuming.

Conclusion

These programs represent only a fraction of the 1,000+ federal grant opportunities listed on Grants.gov, yet they stand out in 2025 for their scale and focus on small businesses. Eligibility often depends on factors such as location, ownership demographics, or innovation type, so it’s important to self-assess early.

To improve your chances:

- Prepare robust applications with data-driven narratives.

- Expect requirements such as environmental impact statements or equity plans.

- Seek personalized guidance through SBA.gov or your local Small Business Development Center (SBDC).

Remember, grants are just one piece of the funding puzzle—they complement other tools like loans, equity investment, or crowdfunding. With persistence and preparation, these programs can propel your small business toward sustainable growth and long-term success.

Looking ahead, FY 2026 budgets may expand opportunities in technology and climate-focused initiatives, so staying informed will be key to capturing future funding.

Leave a Reply